Delphia

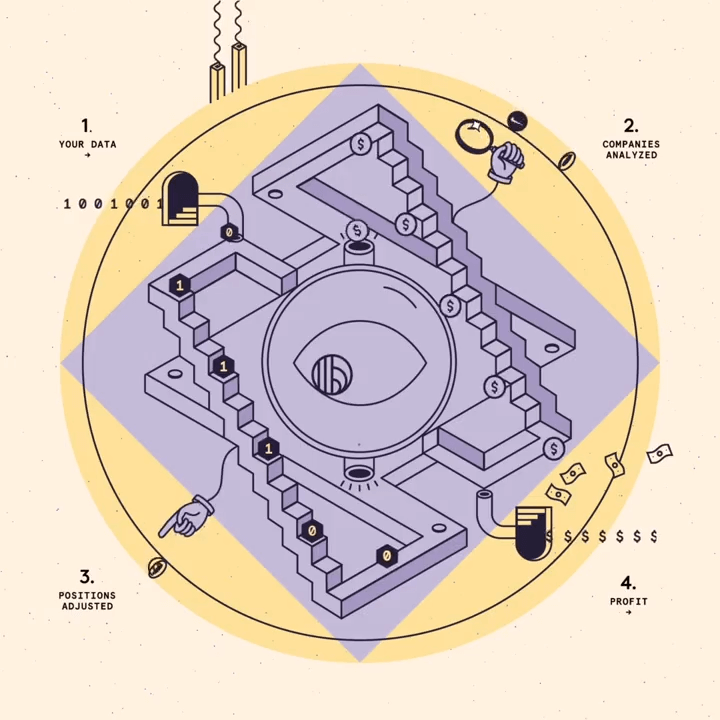

Delphia is a collection of entrepreneurs who believe that in an AI-driven world, data is our most important asset.

We believe the best information is low-latency, asymmetric, and point-in-time; but most critically, that it can be priced.

A Retrospective

- 2011

Future Delphia Cofounder, Cliff van der Linden, pioneers a new way to measure public opinion from big data

- 2013

With a team of data scientists, van der Linden founds Vox Pop Labs to forecast real-world events

- June 2016

Vox Pop Labs predicts several global political outcomes, including Brexit, 10 days before the vote

- August 2017

Future Delphia CEO, Andrew Peek, and van der Linden adapt Vox Pops predictive models to financial markets

- January 2018

Delphia spins out of Vox Pop Labs, is accepted into Y Combinator, and closes two rounds of funding within the year

- 2019

Delphia stops selling its predictions to Wall Street and registers as an Investment Advisor with the SEC

- June 2020

Delphia brings on Jonathan Briggs as Chief Investment Officer

- April 2021

Delphia launches an institutional-grade market-neutral quant equity strategy

- April 2022

Delphia's strategy achieves one of the all-time top 5 years of quant equity performance

- June 2022

Multicoin Capital, with participation from Ribbit Capital and Valor, leads a $60m funding round into Delphia

- 2024

Delphia shuts down its data reward token and robo-advisor, refocuses on professional investors.

- March 2023

Delphia helps to establish Superset as a Data Trust to ensure 'fair trade' compensation for peoples' data

- June 2023

Delphia open sources its backtesting framework, InvestOS, and spins out ForecastOS as a new venture

- May 2024

Delphia partners with an experienced group of asset management executives to grow its hedge fund, Oracle Alpha

- November 2024

Delphia launches Tilt as a way for anyone to invest in the trends they believe in

- Coming Soon

Delphia launches Backchannel as a way for experts to own and monetize their knowledge

News Coverage

Algorithmic Stock Advisor Delphia Raises $60M Ahead of Rewards Token Launch Machine Learning Hedge Fund Hires AWS's Lead Scientist and Point72 Veteran Andrew Arnold

Read MoreDelphia Raises $60 Million, Aims to Use Social Data to Power Algo Investing, Allowing Anyone to Invest Better

Read More

Delphia spins out ForecastOS – a way for anyone to build a quantitative investment strategy with confidence

Get ForecastOS

Delphia and ForecastOS open source an institutional-grade portfolio engineering and backtesting framework

View on Github

Delphia helps to establish Superset as a Data Trust to ensure "fair trade" compensation for peoples' data

Read More